nebraska property tax calculator

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Max refund is guaranteed and 100 accurate.

Property Taxes Jump Most In Four Years With Sun Belt Catching Up

Nebraska Tax CalculatorEnter Value Filling StatusCalculate Whether youve f.

. Nebraska property tax calculator get link. Whether you are already a resident or just. Whether you are already a resident or just.

There are four tax brackets in. See Property Records Tax Titles Owner Info More. Free means free and IRS e-file is included.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The tool helps residents calculate the new refundable income tax credit available this year that allows taxpayers to. Search Any Address 2.

For comparison the median home value in Lancaster County is. Search Any Address 2. Ad Get In-Depth Property Tax Data In Minutes.

Nebraska launches new site to calculate property tax refund. 1st Street Papillion NE 68046. Ad Premium federal filing is 100 free with no upgrades for premium taxes.

Start Your Homeowner Search Today. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Nebraska property tax records tool to get more. Nebraska property tax calculator get link.

Start Your Homeowner Search Today. If you are interested in refinancing a property in Nebraska or are looking to purchase a home there our Nebraska mortgage rates guide has important information that will help answer all of. Nebraska property tax calculator get link.

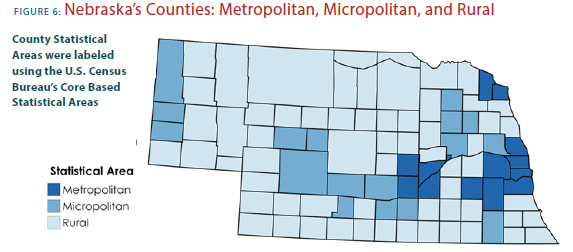

Sarpy County Courthouse Campus 1210 Golden Gate Drive Papillion NE 68046 402-593-2100 Sarpy County 1102 Building 1102 E. The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000. Property tax rates in Platte County rank in the bottom half of Nebraskas 93 counties.

See Property Records Tax Titles Owner Info More. Its important to note that some items are exempt from sales tax in Nebraska including prepared food and related ingredients. Max refund is guaranteed and 100 accurate.

This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Nebraska property tax records tool to get more. Counties in Nebraska collect an average of 176 of a propertys assesed fair. Whether you are already a resident or just.

For comparison the median home value in Nebraska is. The average effective property tax rate in Platte County is 151. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. AP Nebraska taxpayers who want to claim an income tax credit for some of. Nebraskas state income tax system is similar to the federal system.

Nebraska Property Tax Calculator - SmartAsset. Free means free and IRS e-file is included. For comparison the median home value in Lincoln County is.

Property 1 days ago Nebraskas largest county by population Douglas County also has some of the highest property tax rates. Nebraska school district property tax look-up. Ad Premium federal filing is 100 free with no upgrades for premium taxes.

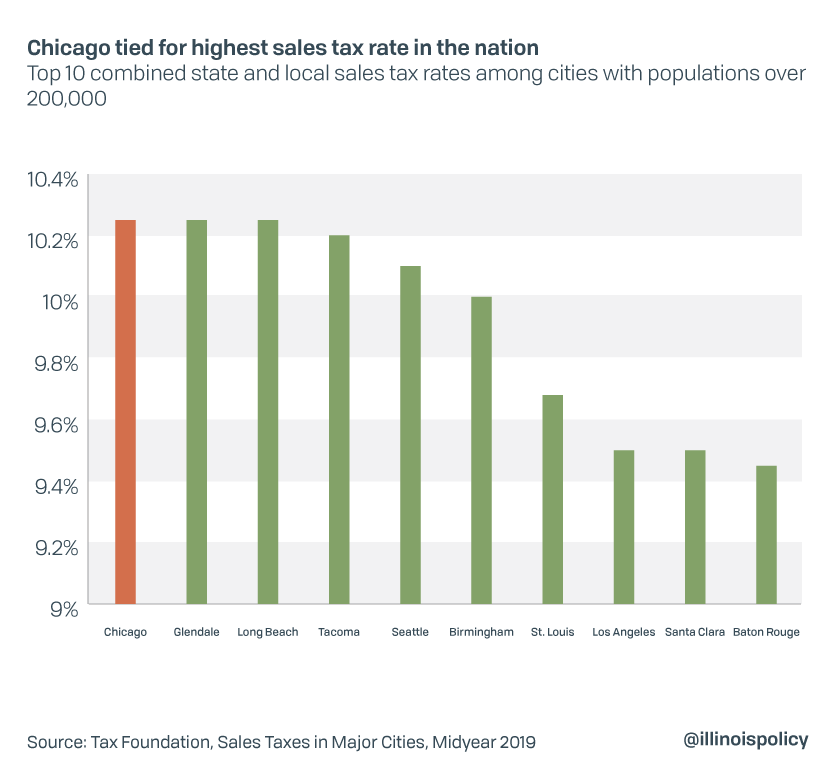

As of 2019 the Nebraska state sales tax rate is 55. The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called Nebraska Property Tax Credit Click here to learn more about this free subscription. Make this tax season easier on yourself by using our Nebraska income tax calculator.

Its a progressive system which means that taxpayers who earn more pay higher taxes. Ad Get In-Depth Property Tax Data In Minutes.

States With The Highest And Lowest Property Taxes Property Tax Tax States

This Time It S Personal Nebraska S Personal Property Tax

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

State Tax Levels In The United States Wikipedia

Property Tax Calculation Douglas County Treasurer

Property Taxes Sink Farmland Owners The Pew Charitable Trusts

What Goes Into Calculating Your Property Tax Bill

Omaha Property Taxes Explained 2022

Sales Taxes In The United States Wikipedia

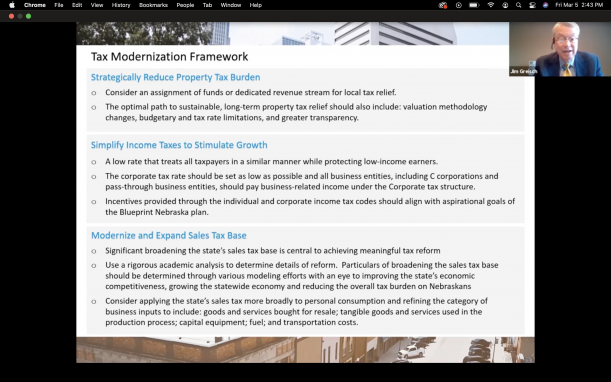

Property Tax Reform Is Focus Of Nebraska Hearing Brownfield Ag News

General Fund Receipts Nebraska Department Of Revenue

Taxes And Spending In Nebraska

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Houston City Council Approves New Lower Property Tax Rate For 2023 Houston Public Media Texas News

Tax Calculator Chanute Ks Official Website

Nebraska S Housing Market Heating Up Federal Reserve Bank Of Kansas City

Nebraska Inheritance Tax Update Center For Agricultural Profitability